Insurance

What Is Insurance | Types And How It Works

An insurance policy is a legal arrangement between an insurer (insurance firm) and an insured (person) in which the insured receives financial protection from the insurer for losses that may occur under certain conditions.

An insurance policy requires the insured to pay regular premiums to the insurer. If a terrible event occurs, such as the death of the life insured or damage to the insured’s or his property, the insurer pays the insured a predetermined value.

Learn more about Insurance Plans

Insurance – Meaning and Definition

Insurance means protection against unexpected losses. This implies you can be paid if a life event causes a financial loss. For instance, your automobile is damaged in an accident on the way to work. You can get your insurer to cover repairs. The insurer will not cover typical wear and tear like a broken headlamp. Law defines insurance as a contract where the insurer compensates the insured for unforeseen losses. The contract includes a premium. Maximum benefit is sum assured or sum insured.

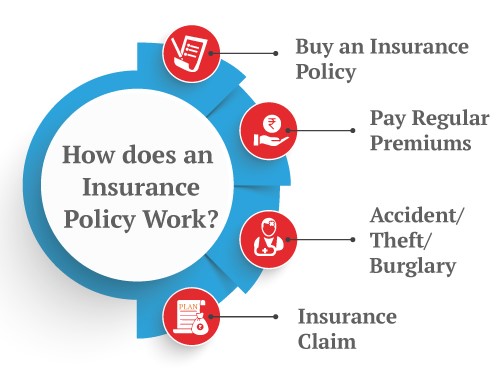

How does an Insurance Policy Work?

To understand how insurance works, you should know below terms:

- Premium: is the money you pay to the insurance company to avail of insurance policy benefits.

- Sum Insured: Sum insured is applicable for a non-life insurance policy like home and health insurance. It refers to the maximum cap on the costs you are covered for in a year against any unfortunate event.

- Sum Assured: Sum assured is the amount the life insurance company pays to the nominee if the insured event happens (death of insured).

As mentioned, insurance is a legal contract between insurer and insured. The insurance policy details the conditions under which the insurer must pay you or the nominee. When you obtain an insurance policy from the company, you must pay a premium for a set time. The insurance firm charges all customers. They share losses from insured events. No claims during the policy period may result in no benefits. It depends on policy and conditions.

Also Read – Different types of insurance policies

Insurance Components

An insurance policy is made of multiple components. Some of the important parts of an insurance contract are:

- Premium: This is the financial consideration which makes the insurance agreement a legally binding contract.

- Policy Limit: Policy limit applies to health and general insurance policies where compensation depends on the amount of loss. The policy may limit the maximum compensation for certain types of losses.

- Deductible: Deductible applies to general insurance and health insurance policies. A deductible is the maximum amount of loss you will bear out of your pocket. The insurer will start paying only when your losses (or expenses) rise above the deductible limit.

Insurance contracts have generally been divided into two groups. The following classes are based on insurance principles:

| Life Insurance | General Insurance |

| Term Life Insurance | Health Insurance (Mediclaim) plans |

| Endowment Life Insurance | Vehicle Insurance |

| Moneyback Plans | Fleet Insurance |

| Savings Plans | Home/Property Insurance |

| Child Education Plans | Fire & Hazards Insurance |

| Unit Linked Insurance Plans (ULIPs) | Travel Insurance |

| Liability Insurance | |

| Keyman Insurance |

Types of Insurance Policies

- Life Insurance Policy

It’s life insurance. You get life insurance to ensure that your loved ones are financially secure even if you are not present. If you are the sole breadwinner, you want your family to preserve their current living conditions in the event of your untimely death. The nominee receives the sum assured in the event of your death. Must Read – What is Life Insurance?

- Health Insurance Policy

Although health insurance is typically categorized as a general insurance contract, there are a few exceptions. Health insurance covers the cost of expensive medical treatments. You can get two types of health insurance policies:

- Mediclaim Insurance: which compensates you for the medical expenses

- Critical Health Insurance: which offers lump-sum payments for dangerous and life-threatening health conditions

Non-life Insurance Policy

These provide compensation for losses incurred as a result of a specific financial event unrelated to life. Non-life insurance includes things like automobile and home insurance. You can get insurance benefits through the following two types of policies. Because of these two variations, health insurance is perfectly positioned between general and life insurance policies. Furthermore, both health insurance policies are critical in providing complete financial security for you and your family.

| Individual Insurance | Group Insurance |

|

|

Key Features of Insurance

The following are the major aspects of an insurance plan that you should evaluate.

- Insurance is a tool for risk transfer.

- Insurance is a community solution as several people, who are exposed to the same risk, pool their funds together to bear the loss.

- The contract is based on the ‘utmost good faith’ principle unlike other business contracts.

- Insurance cover does not affect the chance of loss or minimise the magnitude of loss.

- As a party to the insurance contract, you should always try to avoid, mitigate and minimize the losses.

- You can only insure against risks which are unpredictable in occurrence and magnitude.

- Speculative, financial (betting) and business risks cannot be insured.

Benefits of Insurance

There are several benefits to purchasing insurance, and some of them are stated below:

- Financial Safety for Family: They provide cover against life’s uncertainties and protect you against losses arising from different unexpected events in life.

- Safety of Financial Status: Certain events like medical emergencies can have a significant impact on your cash flow management. Insurance ensures you don’t have to pay out of pocket for such situations.

- Wealth Creation Goals: Insurance policies like ULIPs give you investment opportunities and help you fulfil your essential financial goals.

- Wealth Preservation: Life insurance policies like endowment and moneyback plans are some of the safest long-term investments possible. These plans help you preserve your wealth from inflation and taxes for long periods.

- Wealth Distribution: Few investment plans offer the kind of safety offered by life insurance pension plans. After retiring at the age of 60, you can live up to 100. Only life insurance pension plans can guarantee a regular income for that period.

Must-Have Life Insurance Policies

Insurance is a crucial part of our lives. Whether it’s a life insurance policy or a car insurance policy, having insurance coverage can benefit us financially at various stages of our lives. The following are the many forms of insurance coverage that one should have:

- This is the most basic type of life insurance: you pay a premium for the policy, and if you die within the policy’s term, the nominee receives the sum assured. Term insurance provides excellent coverage for a lesser rate. Canara HSBC Bank of Commerce Life Insurance’s iSelect Smart360 Term Plan covers critical sickness for 40 identified illnesses.

- Given the escalating expense of healthcare and the variety of diseases that can occur, it is prudent to maintain a financial cushion for health emergencies. A health insurance plan will pay your healthcare bills in accordance with the health policy that you have.

- Motor insurance is required for everybody who owns a vehicle in India. It is mandatory to obtain third-party liability motor insurance. However, you can get a comprehensive package – personal accident insurance that covers the risks of harm.

- Your home is vulnerable to a variety of threats, including robbery and damage caused by natural disasters. To safeguard your property from such disasters, you must obtain home insurance.

Such insurance coverage will keep you afloat even after a pricey catastrophe or disaster.

Tax Benefits of Insurance

Insurance provides both financial stability and tax benefits. Here are some of the tax benefits provided by insurance:

- You can claim a life insurance premium of up to Rs 1.5 lakh under Section 80C.

- Under Section 80D, you can claim a medical insurance premium of up to Rs 25,000 for self and family and additional Rs 25,000 for parents. The deduction limit rises to Rs 50,000 if the insured are senior citizens.

- Under Section 10(10D), the life insurance benefits you or the nominee receives from the insurance company are tax-exempted. This means both maturity value and death benefit received from a life insurance policy will be tax-free.

However, the maturity benefit is tax-free provided your yearly policy premium does not exceed 10% of the policy’s base life cover.

FAQs

- Which type of insurance is the most important?

There are two types of insurance needs – long-term and short-term. Short-term needs are usually for less than one year to up to 3 years. Long-term insurance needs can last for a lifetime. Long-term insurance needs such as life insurance and health cover needs are usually permanent. However, insurance needs such as car insurance, travel insurance, etc. would be there for a limited period only.

- What is the difference between life insurance and general insurance?

One of the main concepts of insurance, the ‘principle of indemnity,’ does not apply to life insurance policies. This principle states that insurance payments should never exceed the magnitude of the loss. However, in circumstances of death, the degree of loss is unknown.

As a result, the benefit would be limited to specific times of annual income. In general, insurers limit the benefit to 20 times, but it may increase if your financial situation improves.

- How many claims can I file under my insurance policy?

Life insurance products allow you to file only one claim per incident. For example, if your life insurance policy provides coverage for total and permanent incapacity, you can only file one claim. Although your life insurance will continue after this, the insurer will not accept another disability claim under the same policy.

General insurance policies, on the other hand, allow you to file claims until your sum insured is depleted. For example, a Rs 5 lakh family health insurance policy will pay medical expenditures for any covered family member until the reimbursement cap is reached.

- What is the cashless facility in an insurance policy?

Motor, travel, and health insurance policies all include a cashless option. The cashless feature streamlines the procedure of claiming refunds from the insurer after incurring charges. It allows you to get your vehicle treated and repaired without having to deal with paperwork. A cashless option is quite handy because you may not always have available cash in the event of an emergency.