Insurance

What Is Flood Insurance, How It Works And Example

What Is Flood Insurance?

Flood insurance is a type of property insurance that provides coverage for damages caused by water damage, specifically flooding. Floods can be caused by strong or persistent rain, melting snow, coastal storm surges, clogged storm drains, or levee dam failure. In many regions, a flood is considered a big event, and the damage or devastation it produces is not covered if you do not have extra insurance.

How Flood Insurance Works

A flood insurance policy is a sort of catastrophe insurance that differs from the standard hazard insurance coverage provided by a homes insurance policy. Flood insurance coverage are offered for both residential and commercial premises. Standard homes insurance covers indoor water damage caused by storms or busted pipes. However, it often does not cover flood-related destruction or damage. Property owners who live in flood-prone areas typically require specific insurance.

Flood insurance operates similarly to other insurance products. The insured (property owner) pays an annual premium based on the property’s flood risk and the deductible selected. If the property or its contents are damaged or destroyed by floods caused by an external event such as rain, snow, storms, or collapsed or failed infrastructure, the homeowner is insured. They receive pay for the amount necessary to repair the damage and/or reconstruct the structure, up to the policy limit.

Unlike a conventional homeowners policy, flood insurance requires a policyholder to purchase two policies to protect both the structure and its contents. A separate coverage rider is required to cover sewer backups that were not caused by rising floodwaters.

Tips: Flood insurance is required for a federally backed mortgage on property located in a federally designated flood zone.

- The National Flood Insurance Program

The Federal Emergency Management Agency (FEMA) manages the National Flood Insurance Program (NFIP), which provides flood insurance to homeowners in participating towns as well as those in NFIP-designated floodplains. Insurance policies are issued by private insurance companies rather than the NFIP or FEMA.

The Federal Emergency Management Agency (FEMA) updates maps of flood zones in the United States, which are the areas most likely to be flooded. FEMA modifies the zones to reflect new and increasing weather patterns. The zones are divided into subsections for rating reasons. Properties in zones B, C, and X have a moderate to low risk of flooding. Low risk indicates that there is less than a 1% likelihood of annual floods.

Properties in zones marked with an A are deemed high risk. They are further broken down, with descriptions of anticipated floodwater heights and predicted occurrence rates for a 30-year mortgage term. Properties designated V are identical to those located in zone A. These are high-risk regions located along the coastline.

Some homeowners may live in Zone D, which means that a decision has yet to be made for the region. Flood zone maps are constantly updated to account for shifting weather patterns and man-made alterations to the environment, such as dams and levees.

- The Cost of Flood Insurance

The NFIP governs the pricing of flood insurance plans, and the cost will not vary between issuers. If you live in a flood zone or a community that participates in the National Flood Insurance Program, the NFIP can assist you in finding an insurance agent.

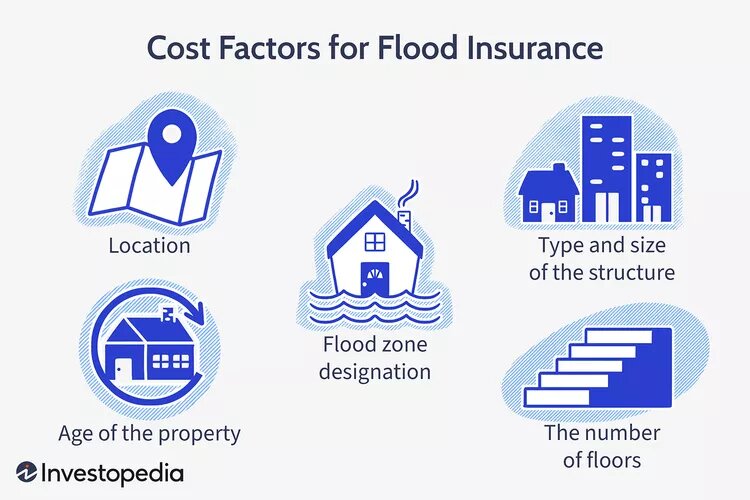

Your agent will consider criteria such as your home’s location and structure, as well as its proximity to a body of water and elevation, when determining the cost of your policy. Costs will also be influenced by the type of coverage you choose, such as replacement cost value versus real cost value.

Pricing can be influenced by a variety of factors, including flood zone designation, property age, and floor count. A Preferred Risk Policy (a low-cost flood insurance policy) offers both building and contents coverage for properties in moderate-to-low risk zones for a single payment. Certain localities that have put in place flood mitigation measures are also eligible for NFIP subsidies. As a result, annual premiums vary greatly.

The typical annual cost of a National Flood Insurance Program coverage The maximum coverage limit for residential structures under NFIP policies is $250,000 for the building and $100,000 for the contents. Businesses can get up to $500,000 in building and contents coverage.

Of course, you can always look for coverage on your own, especially if you wish to insure your property for a higher sum (rates for additional coverage are not controlled). Often, starting with the company that issues your regular homeowners policy is a good choice.

- When Is Flood Insurance Required?

Of course, you can always look for coverage on your own, especially if you wish to insure your property for a higher sum (rates for additional coverage are not controlled). Often, starting with the company that issues your regular homeowners policy is a good choice.

- What is the National Flood Insurance Program (NFIP)?

The National Flood Insurance Program (NFIP), overseen by the Federal Emergency Management Agency, provides federally backed flood insurance to member towns as an alternative to disaster relief. The policies are issued by private insurers.10. Benefits.gov. “National Flood Insurance Program.”

- Is Flood Damage Covered by Home Insurance Policies?

Flood damage is usually not covered by ordinary house insurance providers. Flood insurance is a separate policy that covers damage to the property and its contents.

The Bottom Line

Whether or not flood insurance is a smart idea for you is determined by a number of criteria, the most important of which is whether your property is located in a region prone to flooding. However, floods can occur anywhere. You do not have to live near water for your home to flood as a result of storms, melting snow, or clogged drains. Remember that if you want to protect yourself against the costs of flood damage, you’ll need to purchase a separate policy in addition to your homes insurance.

Source: Investopedia