Insurance

The Best Cheap Health Insurance Plans In July 2023

Health insurance protects against unforeseen medical costs, making healthcare affordable for everybody. Many families struggle to afford health insurance. With so many plans with different benefits, limitations, and costs, finding cheap health insurance can be difficult. Learn how to choose a cheap insurance plan and find the best one in your area.

Best cheap health insurance in 2023: shortlist

Finding an affordable, suitable health insurance plan in today’s quickly changing healthcare industry might be difficult. Fortunately, we’ve listed the finest 2023 low-cost health insurance plans. These plans provide comprehensive coverage and affordable medical care for you and your family:

- Kaiser Permanente – offers best affordable options in multiple states

- Blue Cross Blue Shield – great options with HMO and PPO plans

- Aetna – best network coverage and wellness programs

2023 promises affordable health insurance. Kaiser Permanente, Blue Cross Blue Shield, and Aetna are top providers with affordable prices and extensive coverage. Remember, choosing health insurance wisely can affect your health and finances. Compare these top competitors to obtain the lowest health insurance plan that meets your needs.

All U.S. states offer private health insurance, but low-cost plans differ. Some states have more insurance alternatives and competition than others. Under the Affordable Care Act (ACA), some states have expanded Medicaid eligibility, giving low-cost or free health insurance to income-eligible individuals.

Your healthcare demands, geography, and money determine the best affordable health insurance provider. To select the right plan, compare plans and providers.

Here are a few Private options:

1. Kaiser Permanente

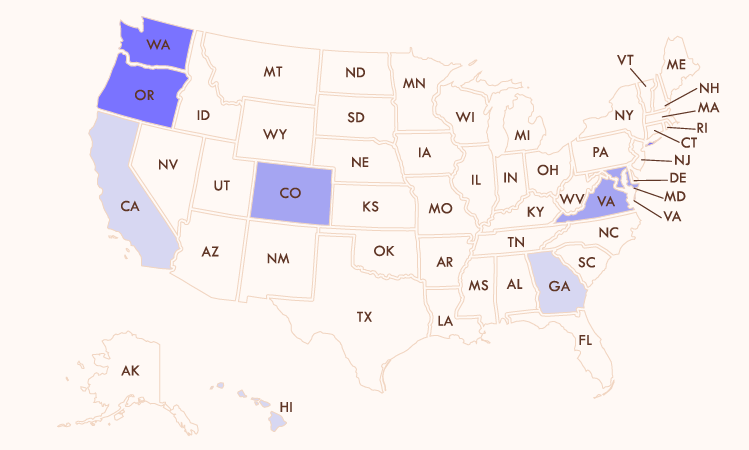

Kaiser Permanente offers cheap insurance in California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and Washington, D.C. HMO and PPO plans with different deductibles and coverage levels match different budgets. Kaiser Permanente provides dental, vision, and mental health coverage.

They also have a network of hospitals and doctors, which can keep costs down for members. Overall, Kaiser Permanente is a good option for those seeking affordable private health insurance in select states with a well-established network of providers.

2. Blue Cross Blue Shield

Blue Cross Blue Shield offers affordable health insurance in several states. Blue Shield health insurance covers preventive care, emergency treatments, and prescriptions. Benefit-rich HMO and PPO plans are available. Blue Shield is available nationwide. State-specific policies and coverage differ. Check the Blue Cross Blue Shield website or call customer service for state-specific plans and coverage specifics.

3. Aetna

Aetna has HMO, PPO, and POS plans. Their network of thousands of doctors covers preventive care, specialist consultations, and prescription medications. Wellness programs and online tools are also available from Aetna. Aetna offers plans nationwide. Aetna’s state-specific plans can be found on their website or by calling an insurance agent.

To compile the rating of the best affordable health insurance plans in 2023, we evaluated various crucial parameters. Cost, state availability, provider benefits, plan features, customer happiness, and the number of networks are among the criteria. We might examine each insurance provider’s overall performance by analyzing publicly available data and deriving generalized conclusions.

- Cost. We examined the affordability of insurance plans offered by each provider, considering monthly premiums, deductibles, and out-of-pocket expenses. We also considered the value for money regarding coverage and benefits provided.

- State availability. We considered the number of states in which each provider offers its insurance plans. This factor determined the accessibility of the provider’s services to a wider population.

- Provider benefits and plan features. We examined the scope of coverage provided by each insurance plan, including preventative care, specialist visits, prescription drugs, and optional benefits such as dental, vision, or mental health services. The comprehensiveness of the designs, as well as the flexibility they provided, were critical factors.

- Customer satisfaction. The provider’s performance was determined using publicly available data, such as the National Committee for Quality Assurance (NCQA) ratings. A high level of customer satisfaction shows that the consumer had a pleasant experience with the insurance company and its services.

- Number of networks available. A larger network of hospitals, doctors, and healthcare providers ensures better access to healthcare services, potentially reducing costs for members.

We ranked the best 2023 affordable health insurance policies using these characteristics. However, individual preferences and needs may differ, so we encourage researching and comparing plans to discover the greatest fit for your unique situation.

How to find cheap health insurance in your state

Depending on your situation, you may be eligible for:

- Marketplace insurance

- Medicare

- Medicaid

- Employer-sponsored insurance

All are affordable. Finding the lowest health insurance plan for your needs requires research and comparison.

The Health Insurance Marketplace at Healthcare.gov lets you compare state plans and rates. Some states have cheaper health insurance choices. A high-cost-of-living state like California may have more expensive plans than Iowa. Compare plans and prices to find the best fit for your budget and healthcare needs.

Plan comparison:

- Go to healthcare.gov

- Click “See Plans” to begin browsing.

- Enter your zip code to find available plans in your area.

- Enter your household size and income to see if you’re eligible for subsidies to lower your costs.

- Review the available plans and compare their premiums, deductibles, out-of-pocket costs, and network coverage.

- Use the filters to narrow down the plans by type (e.g., HMO, PPO) and metal tier (e.g., Bronze, Silver).

- Choose the plan that best meets your needs and budget.

- Enroll in the plan by following the instructions on the website.

Affordable health insurance depends on age, region, and healthcare demands. Compare employer, Marketplace, and government plans to estimate the cost of a low-cost plan.

Health insurance is made up of these general costs:

Insurance cost Price range

Monthly premium $400–800 per month

Deductible $1,500 – $2,000 annually

Copayments $20 $50 per service

Coinsurance 0%–40% of service cost

Out-of-pocket costs Maximum of $9,100 annually

Averages for an individual health plan do not reflect all plan types or plan member demographics.

Low-premium plans usually include higher deductibles, copayments, and coinsurance. Care costs higher but premiums less. Some cheaper plans have smaller networks, limiting your healthcare provider options.

If you’re healthy and don’t need medical treatment often, a cheap plan may work. Preventive care, prescription medications, and emergency services are still covered by low-cost plans.

It’s important to consider your healthcare needs when choosing a plan. Compare your options carefully and read the fine print to make sure you’re getting the coverage you need at a price you can afford.

There are many different types of plans available, including plans based on metal tiers for marketplace exchange plans:

- Bronze plans

- Silver plans

- Gold plans

- Platinum plans

Each plan has different levels of coverage, with bronze plans having the lowest monthly premiums and the highest out-of-pocket costs, while platinum plans have the highest premiums and the lowest out-of-pocket costs.

HMO or PPO? PPO plans let you to see in-network and out-of-network doctors but have higher premiums and deductibles than HMO plans.

A health insurance plan’s metal tier—bronze, silver, gold, or platinum—reflects its actuarial worth, or predicted health care coverage. HMO and PPO plans’ metal tiers are unrelated. HMOs and PPOs differ in provider networks, cost-sharing, and service access.

How can I lower my health insurance costs?

Lower your health insurance costs by considering high-deductible plans, shopping around for the best deals, staying in-network, maintaining a healthy lifestyle, taking advantage of employer or government subsidies, and reviewing your coverage regularly.

What are the main types of health insurance?

The main types of health insurance include individual and group plans and government-funded programs like Medicare and Medicaid. These may include different levels of coverage or network options, such as HMO or PPO plans.

Is it mandatory to have health insurance?

There is no federal penalty for not having health insurance, but some states have mandates requiring residents to have coverage or face a penalty, so check your state’s health insurance marketplace website or the state government website. These penalties are incurred upon filing your taxes.