Insurance

The Difference Between Medical Aid And Medical (Health) Insurance

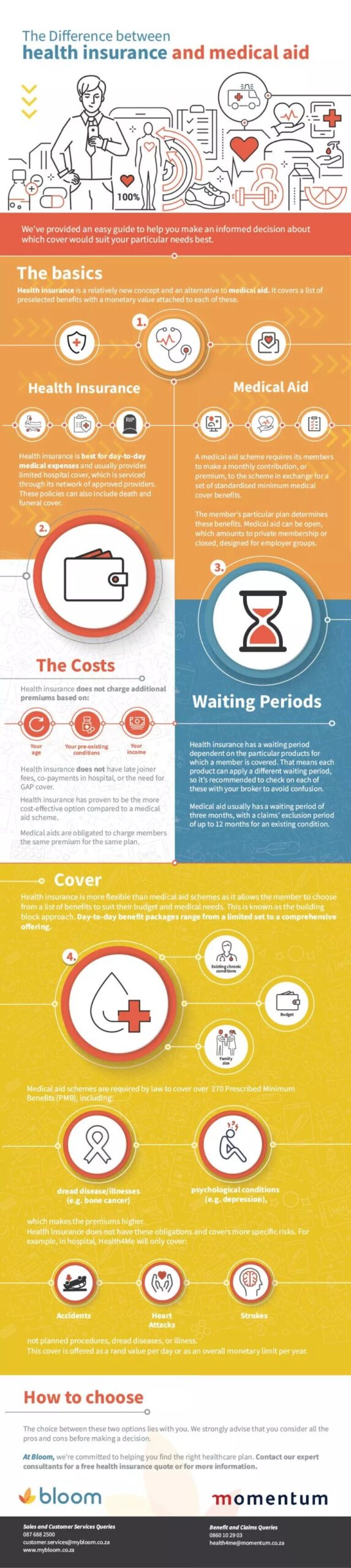

What is the difference between medical aid and medical insurance?

Medical (health) insurance plans cover a set of preselected benefits with cost attached to each. Medical aid schemes demand monthly premiums for standardized minimum benefits. Health insurance reimburses members, who then pay their service providers. Medical aid pays providers directly.

Which is better: Health insurance or Medical aid?

Health insurance is cheaper than most medical aid plans. This has given many low-income South Africans access to high-quality, private healthcare. Medical insurance saves policyholders money by covering medical expenses. Members have access to private medical facilities and healthcare professionals at low fees.

Health insurance is better for day-to-day medical expenses and normally covers just accidents and emergencies through its network of approved medical providers. Medical aid plans can cover more in-hospital surgical procedures and medical therapy, but the constraints will decide the advantages.

Benefits of having health insurance

Health Insurance has many advantages. By covering a large amount of medical costs, it protects finances. It assures access to high-quality healthcare at private facilities, including preventative care, screenings, check-ups, and treatments that promote health and early disease diagnosis.

However, health insurance is better for day-to-day medical expenses and usually provides limited hospital cover, focusing primarily on accident and emergency coverage through its network of licensed medical providers. Medical aid programs can cover additional in-hospital surgical procedures and medical therapy, depending on the member’s plan.

How does medical insurance work? Key features

Medical insurance will cover some of the expenditures connected with an illness, medical condition, or significant medical event, such as a heart attack. Depending on the type of benefits and health insurance coverage, the member is paid either per day or in a single sum.

- Governed by The Financial Service Board

- More affordable than medical aid but offers less cover in-hospital cover

- Payments are made directly to the health insurance plan member, who must then settle with their respective healthcare providers

- Medical cover is only provided for certain types of illnesses, injuries or procedures as cover/benefits depend on the member’s health insurance plan

- Benefits have their own individual waiting periods

- Can include additional benefits, like accident and emergency cover, maternity lump sum benefits and death/funeral cover

How does medical aid work? Key features

- Governed by The Council of Medical Schemes and The South African Medical Schemes Act

- Medical cover is based on the medical scheme tariff

- Payments are usually made directly to the healthcare service provider

- There are fixed monthly fees

- There is a standardised prescribed minimum benefits list

- Does not include additional benefits

- There is a waiting period for the overall medical aid cover

- If there is a shortfall, the member will be required to cover the price out-of-pocket or through additional medical cover, like Gap cover.

Who is a beneficiary in health insurance and medical aid?

Health insurance and medical aid beneficiaries are those designated to receive benefits. Beneficiaries can be spouses, children, or elderly parents. The health insurance policy or medical aid plan covers medical bills, hospitalization, medicine, and other healthcare services including optometry and dental.

What are ‘waiting periods’ in health insurance?

Health insurance policies have a waiting period before a benefit or cover is provided. Certain services and treatments are not covered during this time. Depending on the product or benefit, waiting periods can last three to six months.

Why is there a waiting period for health insurance?

The reason why there is a waiting period for health insurance is to prevent people from applying for cover when they intend to claim for a certain medical condition or procedure in the near future. This is the reason why maternity or chronic benefits have waiting period exclusions.

What is the cost?

Medical aids charge the same premium for the same plan, whereas health insurance premiums vary depending on the benefits picked by the member.

A member must earn less than R30,000 per month to be eligible for coverage. The Health4Me Bronze entry-level health insurance plan costs as little as R517 per month.

What type of cover or benefits will you receive?

Health insurance members choose perks that fit their budget and medical needs. The building block strategy makes health insurance more flexible than medical aid plans. Medical aids must cover 26 chronic medical illnesses and life-threatening emergencies. Health insurance covers a daily rand value or an annual monetary limit, whereas medical aid covers more.

Health insurance only covers in-hospital emergencies like car crashes and heart attacks, unlike medical help. Before being admitted for surgery, health insurance members must produce a guarantee of payment letter. Medical aid schemes provide a wider range of in-hospital treatments and procedures, but each plan has its own constraints.

How to decide which type of medical cover is right for you

Health insurance is ideal for those who cannot afford private healthcare. However, a complete medical aid plan may be better if you or a family member has a significant or chronic health condition or is expected to need hospitalization soon. Health insurance is cheaper than medical aid and more flexible, but it provides less in-hospital coverage and is better for day-to-day benefits.