Insurance

What Is Child Insurance | How It Works

Life insurers offer investment and insurance plans for children, protecting their hopes and goals. Child insurance can help you fund your child’s education and marriage.

While growing the corpus to meet these ambitions for your child, an insurance plan protects it in event of your death. If you die before reaching the objective, the plan can invest the money and give your child the maturity amount you wanted.

Child insurance plans are part of child-specific financial solutions like education plans. Child insurance programs combine insurance and investment products to protect your child’s future. The life cover is paid as a lump payment at the end of the policy period.

Canara HSBC Life Insurance child insurance programs pay both lump-sum and recurring payments. These quarterly payments coincide with important life milestones like education, marriage, etc. for your child. Child insurance coverage can be customized with riders to meet your child’s needs.

Also Read – What is Insurance?

How does a Child Insurance Plan Work?

Child insurance plans help you accomplish the following two investing objectives:

- Future financial need for the higher education goal of your child

- Need for the financial protection of this goal from your untimely death

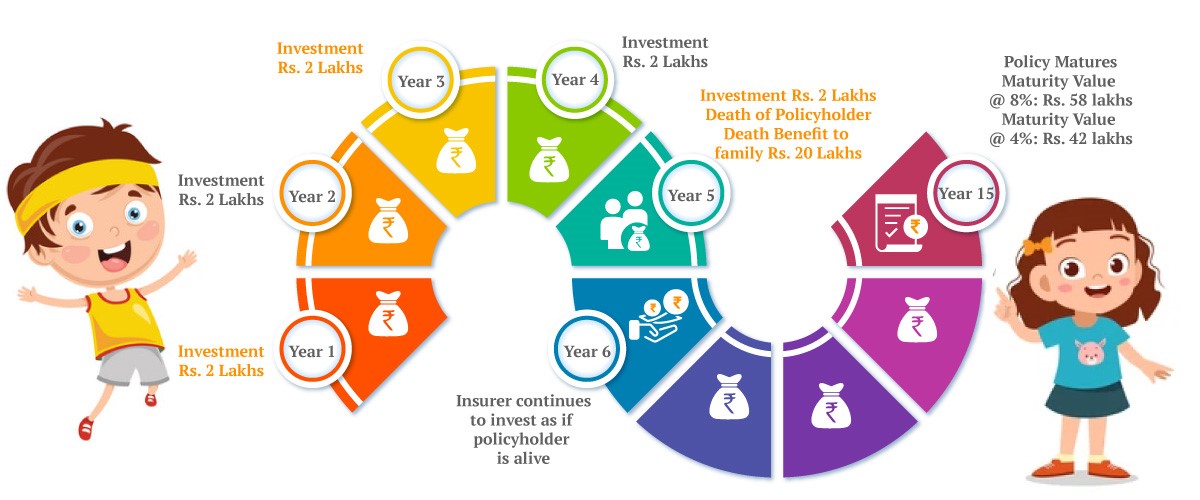

Consider that you are 30 years old when you begin investing in Canara HSBC Life Insurance’s kid insurance plan. Your child is three years old, and you aim to amass Rs. 40 lakhs by the time she turns 18.

You plan to invest Rs. 2 lakhs a year for the next 15 years to achieve this goal using a child insurance plan:

The child plan will usually invest your money according to your fund preferences. At 8% p.a., you may receive Rs. 58 lakhs at maturity, or Rs. 41 lakhs at 4%.

The coverage would pay Rs. 20 lakhs to your family if you die early in the fifth year. They will no longer need to invest in the plan after this payout.

But the plan will get investments as if you remain there till maturity as intended. Based on the plan’s ROI, the family will receive Rs. 41 to 58 lakhs at maturity.

Is Child Education Plan Tax-Free?

Life insurance and investment plans like the child education plan offer tax benefits. The following tax exemptions apply to child insurance and education plans:

- Deduction of Invested Amount: Investment of up to Rs. 1.5 lakhs in child plans is deductible from your taxable income in a financial year.

- Partial Withdrawals: Partial withdrawals from the child insurance plans after the lock-in period is exempt from tax.

- Maturity Proceeds: Amount received from a child insurance plan at maturity is exempt from tax under section 10(10D) to the extent of the following:

- Your investment in any financial year has not exceeded 10% of the life cover in the policy.

- Your annual investment in Child ULIP plans purchased on or after 1st Feb 2021 does not exceed Rs. 2.5 Lakhs in a financial year

Death Benefit: Death benefit your family would receive from the life insurance policy will be exempt from tax.

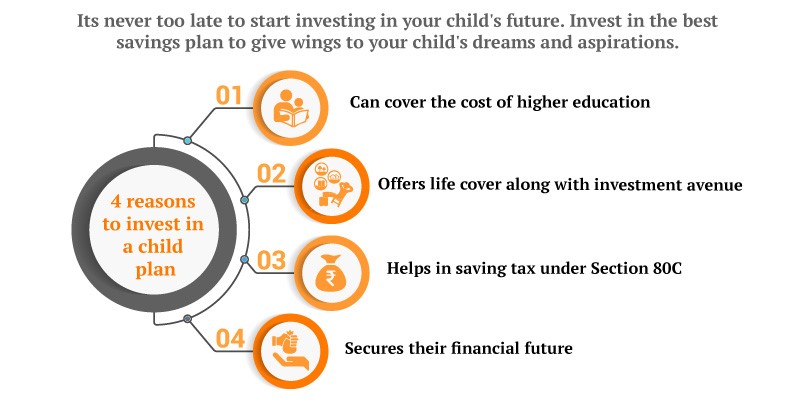

Benefits of Child Insurance Plan

- Guarantee of Support to Child’s Goal

A child plan will assist you in meeting your child’s critical life goals independent of your presence. With life cover and goal protection choices, a kid plan alone is sufficient to guarantee your child’s future, whether through investment or life insurance.

- Boost to the Growth of the Investment

Canara HSBC Life Insurance’s Invest 4G child education plan provides long-term investors with loyalty bonuses and other benefits. The longer you invest, the greater your benefits increase.

- Tax Benefits

The tax benefits of child insurance plans are well known. Investing in kid plans allows you to lower your taxable income by up to Rs. 1.5 lakhs every year. The maturity and partial withdrawals from the plans are likewise tax deductible.

Current higher education costs in India range from Rs. 5 lakhs to Rs. 25 lakhs for your child. You may spend more depending on the degree, course, college, and duration.

Add to this the long-term inflation assumption of an emerging economy, and you may have to pay 20–50 lakhs 10–15 years later. Given time and a fair ROI, Rs. 1–2 lakhs every year should get you close to the objective.

When Is The Right Time To Invest In A Child Plan?

An investment takes time to grow. Money grows better the longer you invest. Thus, investing in your child’s education should begin at birth.

Your child will need most financial support during graduation and post-graduation. If your child hits 18, you should have a large corpus.

How To Select The Right Child Insurance Plan?

The ideal child education plan gives more options for her future. Consider the following factors while choosing the best child insurance plan for your child:

- Goal & Age

First, decide how much to save for your child’s education. This may be difficult while your child is teething and learning to talk. Long-term, prudent preparation helps. You can invest more aggressively for better growth if you have more than 15 years to invest in your child’s future. Thus, your child’s age matters.

- Investment Options

ULIPs and assured child education programs are the main types. While assured plans are safer, ULIP offers additional investing alternatives.

ULIPs are excellent for long-term aggressive investing because they let you invest in equity funds and manage your portfolio automatically. Equity funds can boost your wealth over time (typically over 10 years).

However, if you are short on time and want to attain your goals, Guaranteed Savings Plan is best. Both programs include goal protection.

- Check the Pay Out Methods

Higher education may need annual fees and living expenses. Thus, examine your child’s savings plan’s payment method. ULIPs like Invest 4G Child Plan let you take money gradually or in a large amount in the final years.

- Check the Cost & Past Performance of ULIP Funds

You can estimate ULIP plan returns by looking at past performance and costs. Investments in online child plans like Invest 4G are modest.

- Check the Claim Settlement & Other Ratios

No life insurance plan may be purchased without evaluating the claim settlement ratio, process, and other financial ratios. The claim settlement ratio indicates the insurer’s procedural strength, whereas others indicate financial strength. A claim settlement ratio exceeding 95% is good in Indian life insurance.

How Will a Child Plan Secure Your Child’s Future?

Child plans give goal protection, life insurance, and investments. Goal protection retains your child’s goal investment after your death.

- Safe Investment Option: You can invest safely and achieve the goal regardless of market performance.

- Loyalty Additions: Loyalty and other bonuses work to grow your money faster as you invest for a longer period.

- Life Cover: Life cover will add to the financial support pool for your family immediately after your untimely death.

- Goal Protection Option: Ensures that investment in the future of your child continues until the intended maturity.