Insurance

How To Calculate Insurance Premiums

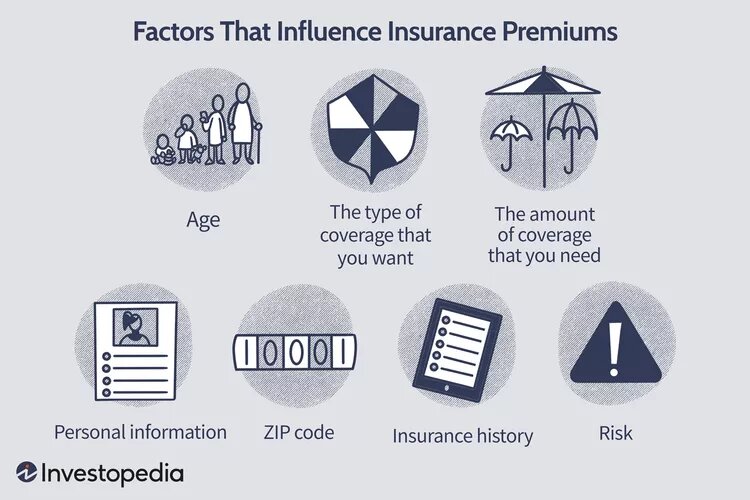

If you have insurance, you may be wondering how companies determine your premiums. You pay insurance premiums for policies that cover not only your health but also your automobile, home, life, and other valuables. The amount you pay is determined by your age, the type of coverage you like, the amount of coverage you require, your personal information, your ZIP code, and other requirements.

What Is an Insurance Premium?

When you have an insurance policy, the insurer costs you money for the coverage. That payment is referred to as the insurance premium. Depending on your health insurance policy, you may pay the premium monthly or semi-annually. In some situations, you may be asked to pay the full price up advance before coverage begins.

Most insurance companies accept a range of payment methods, including online, automated payments, credit and debit cards, cheques, money orders, cashier’s checks, and bank drafts. You may be eligible for a discount if you opt for paperless billing or pay the entire amount at once rather than making minimum installments.

- How Much Is an Insurance Premium?

There is no fixed cost for insurance premiums. You may have the same automobile as your neighbor and pay more (or less) for insurance—even if the coverage is the same. It pays to look around and compare costs and policies. Some insurers provide a cash flow payment plan in which your annual premium is divided into smaller payment units.

You’ll pay more for more comprehensive coverage. For example, a health insurance coverage with a $1,000 deductible will cost more than one with a $5,000 deductible. Similarly, an automobile insurance policy with a $0 deductible will be more expensive than one with a $500 deductible, assuming all other factors are equal.

However, this does not imply you should instantly choose the lowest policy only to save money. When deciding on the appropriate plan for you, you must examine your situation—as well as the possibility that you will need to use that coverage.

- How to Calculate Insurance Premiums

Insurance companies evaluate a variety of factors when determining an individual’s insurance premiums. These criteria will be considered by group insurance companies when calculating a group’s premium.

- Your age: Insurance firms look at your age since it predicts how likely you are to require the insurance. Younger people have lower health insurance rates since they are less likely to seek medical care. Premiums rise as people age and are more likely to require additional medical services. Teenage drivers are still gaining experience, therefore their auto insurance is more expensive. Likewise, senior drivers, who have poorer reflexes, will pay more.

- The type of coverage: When purchasing an insurance policy, you typically have numerous options. The more comprehensive your coverage, the higher the cost. For example, a liability-only auto insurance policy will be less expensive than one that includes collision, comprehensive, liability, medical expenses, and uninsured/underinsured motorist coverage.

- The amount of coverage: Regardless of what you’re insuring, the less coverage you have, the lower your premiums will be. For example, if you get health insurance, a larger deductible and out-of-pocket maximum will result in lower premiums for the same coverage. Similarly, insurance for a $400,000 home will be more expensive than for a $200,000 home.

- Personal information: Depending on the sort of insurance you’re looking for, the insurance company may consider your claims history, driving record, credit history, gender, marital status, lifestyle, family medical history, health, smoking status, hobbies, employment, and location.

- Actuarial tables: Most insurance companies employ actuaries, who use mathematics and statistics to predict the likelihood of an insurance claim based on several of the characteristics listed above. They often create an actuarial table, which is then submitted to an insurance company’s underwriting department, who utilize the information to determine policy prices.

How to Lower Your Premiums

Insurance firms are all about risk assessment. The greater the risk, the higher the premium. Still, there are ways to reduce your premiums. One option is to bundle your insurance. For example, if you have vehicle, house, and life insurance policies with the same firm, you are likely to qualify for a discount.

Of course, reducing your coverage can save you money (for example, increasing your deductible). However, that is not always the best option. Before making any judgments, think about your situation and the chances of you using the coverage.

There are other ways to save money on your rates, but they need more commitment. For example, most jurisdictions charge smokers up to 50% more than nonsmokers for health insurance coverage. For example, if you smoke and pay $600 per month for health insurance, you may be able to cut your premium to $400 if you quit.

Another example: Improving your credit score may qualify you for lower auto insurance premiums. People with lower credit ratings are statistically more likely to file a claim.

- How Much Are Insurance Premiums?

Insurance premiums vary depending on the coverage and the individual purchasing the policy. Many factors influence the amount you’ll pay, but the most important ones are the degree of coverage you’ll receive and personal information like your age and personal information. For automobile insurance, this might include age and driving record. Health insurance coverage may be dependent on personal habits such as smoking or preexisting diseases.

- Does a Higher Insurance Premium Mean Better Insurance?

Not necessarily. Because so many factors influence your rate, it may be greater than someone else’s for the same coverage. You’ll typically pay a higher premium for more comprehensive coverage, such as a smaller deductible, or for extra optional services, such as roadside assistance or rental car insurance.

- How Can I Lower My Insurance Premiums?

The most foolproof strategy to reduce your premiums is to select a lower level of coverage. If you enjoy your current coverage, consider bundling it with other types of insurance to qualify for multi-policy savings. Some health insurance companies provide incentives to encourage healthy habits, such as receiving a yearly health exam or attempting to quit smoking. Some auto insurance providers can cut your costs if you have an excellent driving record or credit score.

Bottom Line

The price of an insurance premium is determined by a number of factors, including age, state and county of residency, and coverage level. You can’t change your age, but you can take advantage of incentives to reduce the cost, such as stopping smoking or raising your credit score. Whether you’re looking to bundle your insurance, modify a health habit, or improve your financial situation, shopping around always pays off. This allows you to obtain the greatest insurance policy at an affordable price.

Source: Investopedia