Insurance

What Is TPA In Insurance

Insurance is a tool for purchasing protection against unforeseen life events that could result in a financial loss. These events include unexpected mortality, chronic illnesses, other major health concerns, automobile accidents, and fire disasters, among others. Once covered, you pay premiums to the insurer, who guarantees to process your claims and recompense you or your loved one for a variety of unexpected life events.

When considering purchasing insurance, you likely come across the phrase “TPA.” Here’s all you should know about TPA and how it works.

What is a TPA?

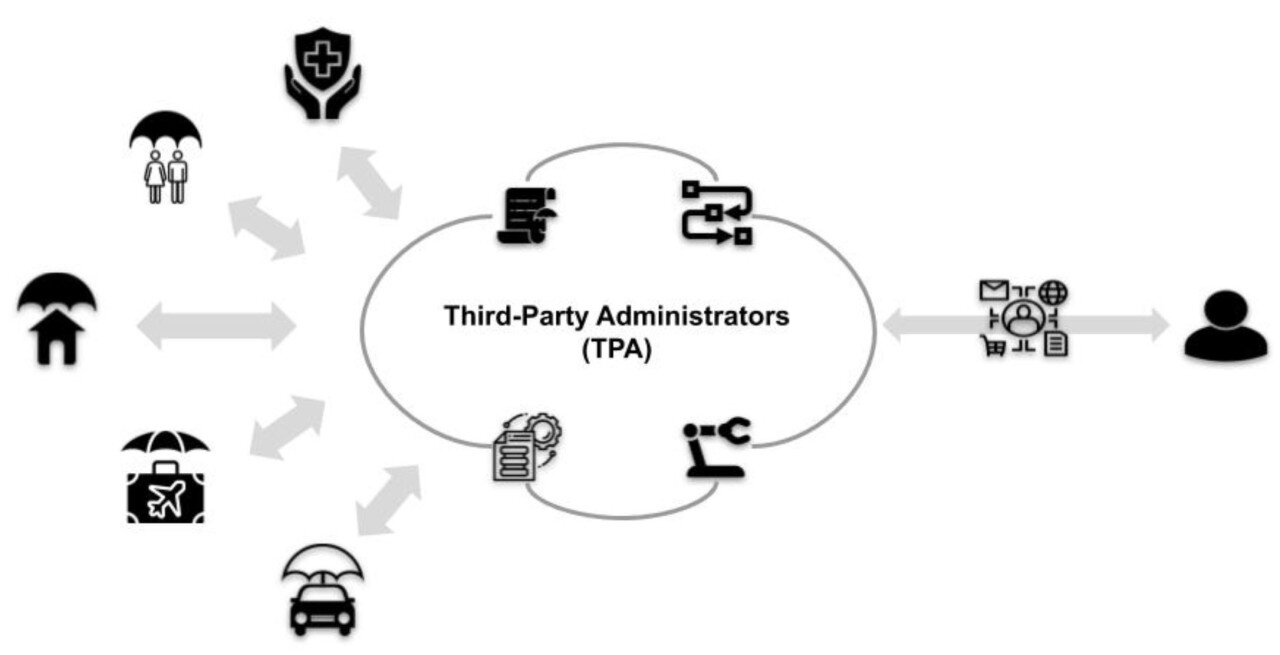

TPA or third-party administrator is an intermediate between the insurance company and you, the policyholder. As the name says, they are a third party. This means that they are neither the policy holder, that is you or also called the first party, nor the direct insurer, which is the second party. Their duty is to serve as a conduit between both parties and perform operational services that allow insurance firms execute various services or benefits that they have committed to their clients.

TPAs are typically utilized by insurers across the world and are always licensed as per local country legislation. These organizations are contracted by various insurers to provide a variety of services that allow their customers to obtain accurate and timely service. These include claims management, policy management, hospitalization support, and, in some cases, underwriting and customer service. Given the volume of claims, payment settlement needs, and the growing need for efficiency, India’s health insurance business has seen the most widespread use of TPAs.

In India, TPAs are licensed by the Insurance Regulatory and Development Authority of India (IRDAI) as per their regulations which are periodically reviewed. These regulations define the minimum requirements to seek registration as a TPA and outline the service offerings and the onus of what an insurer must allow their policyholders should they engage a TPA.

Role of a TPA in Handling Your Insurance Policy

while you or your loved ones require medical care, whether as a result of an accident or illness, TPAs assist you in dealing with the complications that arise while filing health insurance claims. They ensure that you understand the paperwork required for either cashless claims or reimbursement, as well as maintaining track of the necessary papers to support a timely payment. However, insurers are not obligated to use a TPA, and many prefer to handle all of these service operations themselves.

Let’s put this into context with a real-life example: a policyholder named Kuldeep. His father needs to be admitted overnight due to significant chest trouble. The specialists determined that bypass surgery was necessary. Given that he was covered by a health insurance policy with an amount insured of INR 10 lakh, the family was unconcerned about the consequences of this spending. Also, because the insurer and the hospital had a contract, they didn’t have to plan for the big sum required for the bypass procedure.

The insurer had a cashless claims tie up, in this case, the TPA then handled all the paperwork needed to facilitate a seamless process. The TPA also served as the point of contact when the family was informed that select elements of the expense were not covered under the policy, such as a certain room type, and a few elective services that Kuldeep requested.

Given that the TPAs are specialized in understanding health claims, hospital requirements, and insurer procedures, they work hand-in-hand with the insurer to improve the quality of service provided to the policyholder and their family. They also serve as the focal point for ensuring that there are no ambiguities in what hospitals charge for services, and what is covered, and when payments are settled. In essence, they are primarily focused on ensuring peace of mind for the policyholder during the stressful times of a hospitalization.

Why Do We Need TPAs?

India is becoming the world’s most populous country, and healthcare costs are rising annually throughout the country. Our expanding financial prowess, environmental impact, and lifestyle all contribute to the ill health of a big portion of our society. The need of health insurance cannot be overstated, with cardiac problems, diabetes, and an increase in traffic accidents.

As the number of persons insured for health insurance grows, so does the volume of claims. TPAs are frequently required to give scale and competence to a demanding customer among India’s insured. They provide a wide range of services to numerous insurers:

- Issuance of health cards: Whenever a policy is issued to you, a validation process is undertaken in the background to ensure your eligibility for the coverage. This process is completed through the issuance of an authorized health card which consists of details such as the policy number and the TPA responsible for claims processing. When you or a dear one is admitted, you need to produce this card and convey the emergency to your insurer or TPA. The health card is necessary for the processing of the claim.

- Seamless claim processing and settlement: Your TPA is responsible for expediting the claim and completing the processes as soon as intimation is received. The TPA must verify all the documents submitted in favor of the claim and validate the same as quickly as possible, to ensure the least amount of trouble for the policyholder. For this purpose, the TPA is allowed to request for all necessary information, following which, if the claim is validated, the TPA will then settle the claim either via the cashless or the reimbursement method. In the case of cashless settlements, the TPA will acquire all relevant documents from the hospital itself.

- Offering value-added services: TPAs also offer various other services like wellness programs, annual health checks, second opinion services, electronic health records, etc.

- Helpline facility: In addition to the above services, your TPA will also provide you access to all healthcare insurance information and claim assistance through a 24×7 customer service facility. This facility will be made available to you across the country.

- Bolstering hospital networks: Another major role of the TPA is related to strengthening the insurer’s underlying hospital network. TPAs work towards building a strong network of hospitals which offer quality healthcare solutions to policyholders. This is necessary to ensure cashless claims as well as negotiate the rates charged by the hospital.

Policyholders want to acquire insurance from businesses with the largest hospital network because it makes effective care more accessible, and TPAs play a significant role in facilitating this.

Bottom Line

While TPAs play an important role in the health insurance industry, they face numerous challenges, including information asymmetry, an overreliance on paper, disconnected IT systems, and a lack of robust standardized procedures for assessing hospitalization charges and bills.

The growing awareness of consumer rights, social media, and the government’s and insurers’ digitalization efforts have all contributed to a higher service threshold at many TPAs. Insurers are aware of the service demands of today’s workforce and are actively seeking to streamline processes and integrate TPAs into their operations.

The future looks bright for India’s policyholders, and TPAs will continue to play an important role in delivering peace of mind to policyholders.